Staking

Bank Frick offers its clients the opportunity to use their cryptocurrencies to stabilise Proof of Stake networks and generate additional income. As a fully regulated bank, the security of client funds is our top priority.

What is staking?

Proof of Stake (PoS) is an energy-efficient and scalable way to validate new data blocks in a blockchain. PoS enables holders of cryptocurrencies to participate directly in the consensus mechanism, thereby ensuring a decentralised and secure network. The more tokens are staked, the more difficult it becomes for malicious actors to carry out attacks on the network. In contrast to Proof of Work (PoW) networks like Bitcoin, this process does not require complex computational tasks to be solved.

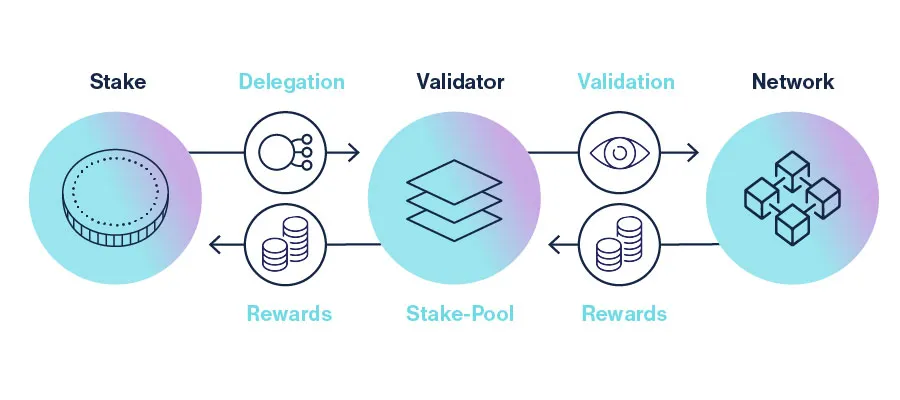

Users assign or “stake” their cryptocurrency as security in order to take part in the blockchain consensus mechanism as a validator. Validators verify the data on the blockchain and contribute to network stability in this way. In return, the validator receives staking rewards for successful block validation, in the form of new tokens. The probability of being selected to create new blocks often depends on the amount of staked assets. If a validator includes incorrect or fraudulent transactions, whether intentionally or by mistake, they are held accountable and their stake is at risk.

A common variant of conventional PoS is Delegated PoS. Here, delegators (those who delegate their tokens) assign their voting rights to trusted staking pools, which carry out the process of block validation.

Which cryptocurrencies can be staked?

Bank Frick currently offers the staking of ETH, ADA, XTZ, SOL, DOT, POL and ATOM. The various protocols differ in terms of their technical details, such as payment payout frequency and unbonding period. Leave the technical processing to us and benefit from staking rewards with our staking service.

Currency |

min. unit |

Activation period |

Payment frequency |

Unbonding period |

|

32 ETH |

Dynamic |

Daily |

Dynamic |

|

1 POL |

- |

Daily |

3-4 days |

|

1 SOL |

2 days |

Per era (every 2 days) |

2 days |

|

1 ADA |

3 eras (≈ 15 days) |

Per era (every 5 days) |

- |

|

1 XTZ |

5 cycles (≈ 15 days) |

Per cycle (every 3 days) |

- |

|

1 ATOM |

- |

Daily |

21 days |

|

Dynamic |

- |

Daily |

28 days |

We are delighted to offer our clients a new way of utilising their cryptocurrencies and thereby generating a return.

What are the risks?

Crypto markets are very volatile and investors need to be aware that cryptocurrencies cannot be sold immediately after unstaking. There is an unbonding period, which can last for different lengths of time depending on the protocol. You can cancel the staking of your cryptocurrenciesat any time by contacting your personal advisor. However, the final payment is subject to the unbonding period specified in the protocol. During this period of time, the cryptocurrencies are blocked and are not available for trading.

The validator is also liable to the extent of their stake if they violate the protocol rules. For example, if an invalid transaction is validated, the validator is given a slashing penalty resulting in corresponding financial losses. A small amount or even the entire stake may have to be paid as a penalty depending on the severity of the violation. The slashed amount is distributed proportionately among the validator’s staking participants.

How is the security of client funds guaranteed?

Close cooperation with providers audited under SOC 2 Type II minimises risks such as slashing as much as possible. Bank Frick also takes additional measures to ensure security for client funds. For instance, a whitelist is used to make sure that staking accounts can only interact with authorised and verified smart contracts.

How can I stake my cryptocurrencies?

Please contact your personal advisor for more details about our staking service or fill in our staking/unstaking application form!