Applying to open an account online

Becoming a client

You can use our digital onboarding tool for this as either a legal entity (company, foundation, holding, etc.) or a private person.

As a regulated bank, we are subject to strict regulatory conditions and need to fully review every application. You can see which requirements you will need to meet below.

Bank Frick supports professional clients as well as financial intermediaries and their clientele

However, we also welcome non-professional clients without a connection to a financial intermediary, provided we can foresee added value on both sides.

We provide services to legal entities and natural persons residing or registered in the European Economic Area (EEA) (consisting of the EU, Liechtenstein, Iceland and Norway), Switzerland, the United Kingdom, Hong Kong or Singapore.

Individuals and businesses domiciled in any other country can become clients in very exceptional cases. A prerequisite for this is that a business relationship must offer additional benefits to both the individual and the Bank.

Should you be interested in opening an account with us, please provide us with information about the origin of your assets, the beneficial owners of the account, the purpose of the account, and the anticipated incoming and outgoing payments. We also need this information to fulfil our legal obligations. The more accurate your information, the quicker we can open your account.

We recommend contacting us before filling out your application. We can offer you a consultation to determine whether we would be able to welcome you as a new client.

Would you like to learn more? Get in touch with us now.

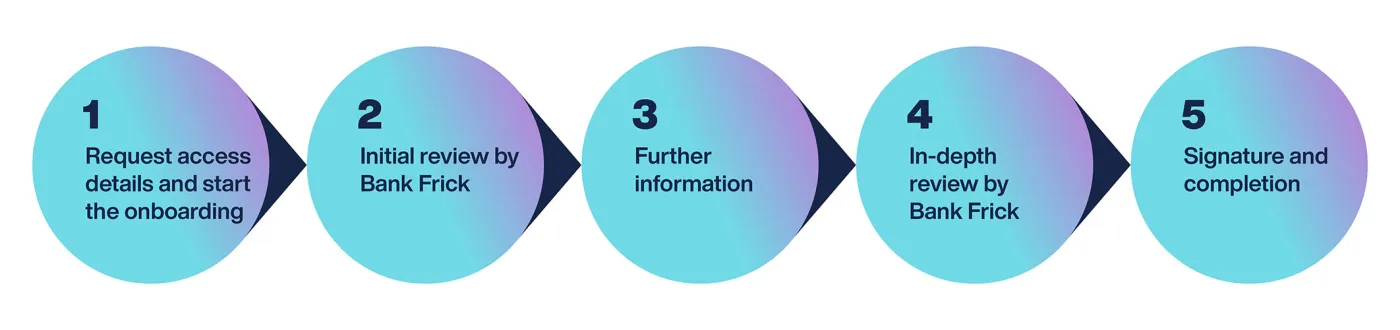

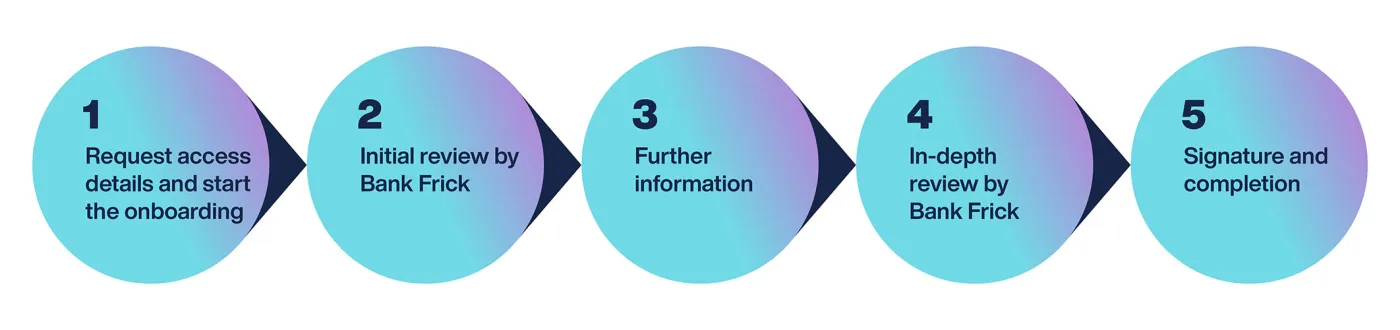

Steps to account opening

However, you can also apply for an account without a prior consultation. These are the steps you will need to follow:

To do this, you will need to send us your name and e-mail address via the form below. We will then send you your personal access details via e-mail. Use the access details to log in to our onboarding tool.

To start, you will provide the initial information we need to review your application. If you meet the requirements, we will inform you of this, again via e-mail.

Should our review yield a positive result, you will be asked to provide information regarding the origin of your funds. During this step, you can also specify all further contacts – such as individuals with signatory and access powers – and upload documents for identification (passport copies) and verification.

We will carefully review your information. If this second review also yields positive results, we will send you the account opening documents via e-mail.

You will print the account opening documents, sign them in a legally compliant manner, and send them back to us. Any final clarifications will be completed once we have received these. We will then open your account and welcome you to Bank Frick.

How long does it take to open an account?

The time required to open an account depends on the complexity of your application – and on the quality of the information that you provide to us.

Apply for account opening

Register with your name and e-mail address for our digital onboarding service and start the account opening process at Bank Frick.