Direct market access – efficient trade execution for fund strategies

Liechtenstein has a long-standing tradition in the fields of banking and asset management. Since joining the EEA in 1995, Liechtenstein’s financial centre has established itself as a professional point of reference for promoters of collective investment vehicles on the European financial market.

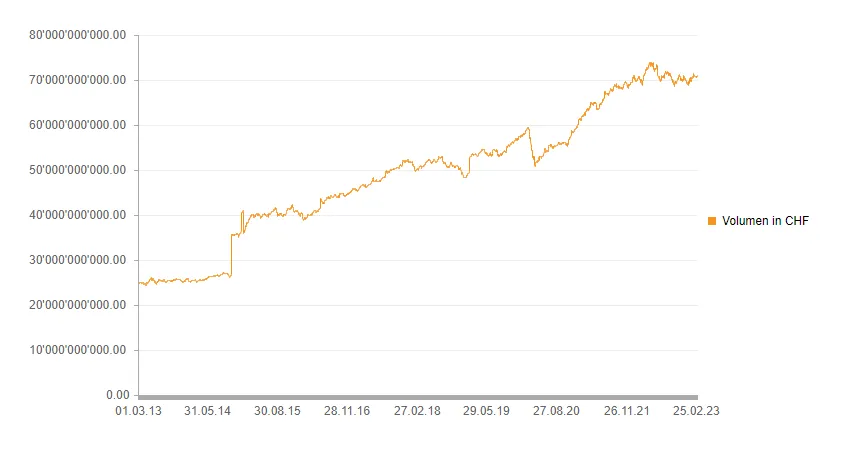

As a leading location for AIFs and UCITS funds, assets totalling around CHF 70 billion from a wide variety of asset classes are currently being managed. Assets under management (AuM) have thus more than tripled since 2013.

In order to comply with the increasingly stringent regulatory and operational requirements, during this time custodians and asset management companies have invested in particular in system solutions for accounting and investment compliance. However, over the same period, processes relating to order execution have experienced considerably less innovation. And yet this specific aspect is the main focus of fund managers, and in most cases plays a decisive role in selecting the fund location.

There are major challenges especially for trading strategies that involve liquid underlying assets. This occurs in particular where they are characterised by a very high transaction frequency or are executed on trading venues in other geographical regions in different time zones. Under these circumstances, in many cases it is extremely difficult to process transactions through the in-house trading desk and to acquire assets outside of opening hours.

In these cases, execution can generally be ensured by involving a prime broker. However, this is associated with high set-up and ongoing management costs. As a result, this option is generally not available to funds that have not reached a particular threshold in terms of AuM, above which such a special arrangement offers value for money.

In order to further increase Liechtenstein’s attractiveness as a fund location, custodians are also called upon to offer innovative, cutting-edge solutions that offer fund managers as much flexibility as possible when executing securities transactions. Under an ideal scenario, a high level of automation would also enable the user to benefit from a more efficient fee structure. This is a significant consideration in cases involving high transaction frequencies.

Direct market access through the custodian’s network

Within a financial world in which platform solutions are increasingly gaining in importance and modular services are becoming more prevalent, there is also a solution for this problematic aspect.

This “direct market access” (DMA) enables fund managers (as well as all other types of asset manager) to implement investment strategies involving liquid securities within the investment vehicles managed by them – without having to follow the circuitous route through the custodian.

Under this scenario, the custodian operates as a platform that specialises in booking transactions and holding assets in custody. Orders are actually placed directly via a network partner. This may for example be an online broker that has established a niche for itself due to its broad market coverage, efficient cost structures and easy accessibility (24/7).

Sub-accounts can be created as a basis for providing further services under the relationship. Sub-accounts are opened by the custodian in its own name, although are used for the respective end clients (e.g. funds) within its broker network. This may be used as a basis, amongst other things, for setting trading limits, geographical restrictions and limitations in terms of permitted financial instruments, which are tailored to the respective end client. Moreover, this also ensures that activities are allocated to one single client relationship and can be automatically fed in to the custodian’s systems at a later stage via an interface. This in turn ultimately serves as a “source of truth” for reporting to the end client.

There are a variety of benefits for asset managers. The custodian not only deals with the process of acquiring assets but also, as the account holder, attends to all tasks relating to securities management (collateral) and cash management. Acting under the terms of a limited commercial proxy, the user places orders conveniently through the online broker’s interface, whilst the custodian operates in the background, dealing with settlement and subsequent recording.

Ultimately, direct market access enables asset managers to focus on their core strengths, thereby deploying their resources more effectively. This leads not only to significant efficiency gains and lower transaction costs, but also increases the competitiveness of Liechtenstein’s financial centre and offers a highly optimised client experience.

Share post

Related Posts

How Blockchain Enables Transparency and Efficiency

Blockchain technology, first demonstrated in 2010 through a historic Bitcoin transaction, has evolved far beyond cryptocurrencies, offering solutions for transparency, efficiency, and decentralization across industries. Its core principles—decentralization, transparency, and immutability—enable secure, peer-to-peer transactions without intermediaries. Innovations like Ethereum's smart contracts have expanded blockchain's capabilities, impacting supply chains, automation, and governance.

Despite concerns about energy use, modern blockchains are increasingly energy-efficient, and misconceptions about complexity or security often stem from misunderstandings. For nonprofits, blockchain offers transformative potential: donations can be transferred quickly, cost-effectively, and transparently, ensuring more funds reach beneficiaries while improving accountability and impact measurement.

As blockchain reshapes societal structures and trust, it presents nonprofits with powerful tools to amplify their impact. Organizations willing to embrace this innovation will be well-positioned to drive meaningful change in an interconnected digital world.

Insights into the process of designing AMCs

Since their introduction, Actively Managed Certificates (AMCs) have become a significant component of the European financial market. As a structured product, legally classified as debt securities, they hold a counterparty risk for the investor that is comparable with other structured financial products. AMCs are securitised, which gives the holder the right to cash repayment or the delivery of an underlying asset. As the buyer, the investor becomes a creditor of the issuer and thus dependent in terms of the type and amount of repayment, which is subject to different parameters.

Ensuring the future of insurance with blockchain technology

The insurance market is an essential part of the global economy, covering both personal and business risks. Thus, it is no wonder that it is one of the largest industries in the world, boasting an estimated value of about USD 5 trillion and employing about 2.7 million people across the globe. Out of USD 5 trillion, around USD 3.7 trillion makes up the value of the global life insurance market, while the value of the property and casualty insurance market carries a value of USD 1.3 trillion.

Tokenisation: A new way of representing assets

Ever since the dawn of time, human beings have hunted and gathered, collecting the things they discovered and making them their own. This was when the concept of ownable assets first emerged, albeit in rudimentary form. Since then, assets have evolved and become more complex as humans have found more reliable ways to connect assets to people. Today, people enter into legal contracts when transferring assets.

Blockchain: A technology with social impact

Foundational technology is the most effective tool for impacting society at large and solving the challenges it is faced with. One such foundational institutional technology is the blockchain, which entered the picture through the discovery of Bitcoin in 2009 and has since proliferated and emerged in many different forms.

What does blockchain’s social impact look like?

How blockchain technology protects us from bad actors in our digital future

The blockchain industry has experienced significant growth in the last couple of years as one unicorn after another sprouts from the soil that grows crypto start-ups. In this new series of blog posts and webinars, we take a closer look at the technology and explore why it is so successful and why everybody is talking about it. We also look beyond the speculative aspect that blockchain is so frequently associated with and focus on the real-world problems that the technology is poised to solve.

Wie klassische Finanzintermediäre in der Krypto- und Blockchain-Welt Fuss fassen können

Mit zunehmender Selbstverständlichkeit fragen immer mehr Kunden nach Dienstleistungen rund um Kryptowährungen. Für Finanzintermediäre eröffnet diese Nachfrage neue Geschäftsmöglichkeiten. Um das Potenzial heben zu können, müssen die Akteure aber auch das Spezialwissen zur Verfügung haben.

Blockchain technology reinvents correspondent banking – just not yet

As one of its major use cases, blockchain technology is said to transform traditional correspondent banking. So far major challenges have pushed back this transformation. It is more likely than ever that with central bank digital currencies on the horizon; blockchain disruption will finally come to fruition in the realm of cross-border banking.

Turning crypto investment into an earning asset

With Ethereum upgrading to Proof of Stake, the crypto world is going through one of its most transformative shifts to date. This means that customers will soon be able to earn interest on their digital asset holdings through a process called staking. What staking is, how it will define the future of Ethereum and digital asset custody at large is explained in this article.

A comprehensive overview of Liechtenstein’s banking regulation

In this in-depth article, the authors show the economic and regulatory environment in which banks in Liechtenstein operate. This article first appeared in the reference work The Banking Regulation Review (Twelfth Edition) published by Law Business Resarch.