News and insights

We know how important it is to have reliable information, facts and background details as good decision-making tools. In our press releases, you can find the latest news about Bank Frick. We provide specialist knowledge about the financial market – both conventional and blockchain-based – in our in-depth blog posts. If you would like to hear exciting updates about the cryptocurrency market, then dive into our Crypto Industry Reports.

News and insights

A dose of comical things happening in crypto lately…

Bankruptcies have become commonplace in crypto, and it almost feels like the industry and community have gotten used to it. The latest company to yield to this legal process is crypto lending firm Genesis Global Holdco, LLC. The company announced it had filed for bankruptcy through a statement dated January 19, 2023. In the statement, Genesis Global revealed that it had “filed voluntary petitions under Chapter 11 of the U.S. Bankruptcy Code” together with two of its lending subsidiaries, Genesis Asia Pacific Pte. Ltd. and Genesis Global Capital, LLC.

The DCG, Genesis, and Grayscale Saga explained

Crypto company Digital Currency Group (DCG) is reportedly under investigation by the SEC and the DoJ’s Eastern District of New York. Interestingly, a spokesperson of the company said they were unaware of the DoJ investigation. The company, which owns trading firm Genesis and crypto wealth management company Grayscale Investments, among other subsidiaries, has been undergoing financial troubles since the collapse of FTX. The issues are tied to the fact that Genesis was an FTX creditor.

Mere FUD or Binance in real trouble?

As those affected by the collapse of FTX rejoice over the recent arrest of Sam Bankman-Fried (SBF), the CEO of Binance is currently dealing with fear, uncertainty, and doubt (FUD) targeted at his cryptocurrency exchange. In a tweet, CZ asked the community to ignore the FUD. “FUD helps us grow. [...]. There has hardly been a week going by without some FUD. We learned the ability to ignore them and keep building,” he said.

Will digital asset darling DCG trigger yet another meltdown?

The FTX’s collapse and its consequences continue to unravel. Venture capital company Digital Currency Group (DCG) could be the latest victim following the current mayhem. Based on a letter to investors, the company has disclosed a $2 billion debt, which mostly consists of intercompany loans between it and its subsidiary Genesis Global Capital.

Crypto poster child FTX goes bankrupt

Last week, the digital asset space got shaken to its core, when the world’s second biggest crypto exchange FTX collapsed overnight. After all, this collapse marks the largest meltdown in the crypto world. The exchange, which bailed out several companies in the wake of the Terra Luna and 3AC collapse earlier this year, has fallen apart so fast and hard, that experts expect the ripple effects to continue in the coming months.

So, what exactly happened?

Is Elon Musk owning Twitter bullish for crypto?

Elon Musk’s actions have once again had repercussions for the wider crypto space. This time, Dogecoin rose by more than 70% in 24 hours, driven by the news that Musk had closed a $44 billion deal to take over Twitter. All in all, Musk’s favourite meme currency experienced a 150% surge from October 25-29.

Another day, another few hacks. That’s the current state of crypto

Crypto projects are getting hacked almost every other week and losing millions of dollars. Sadly, users are bearing the brunt of these attacks. On October 12, Solana-based DeFi platform Mango Markets confirmed that the protocol had been attacked by a hacker, who stole funds through an oracle price manipulation. Mango’s price plummeted by more than 40% as a result.

Screening crypto projects: The regulators are on it

Regulators have had a tough time keeping up with the rapidly growing crypto space that is dominated by a wide range of financial products. Nonetheless, recent developments show that they may be gaining ground signalling that crypto companies need to evaluate their compliance status now more than ever.

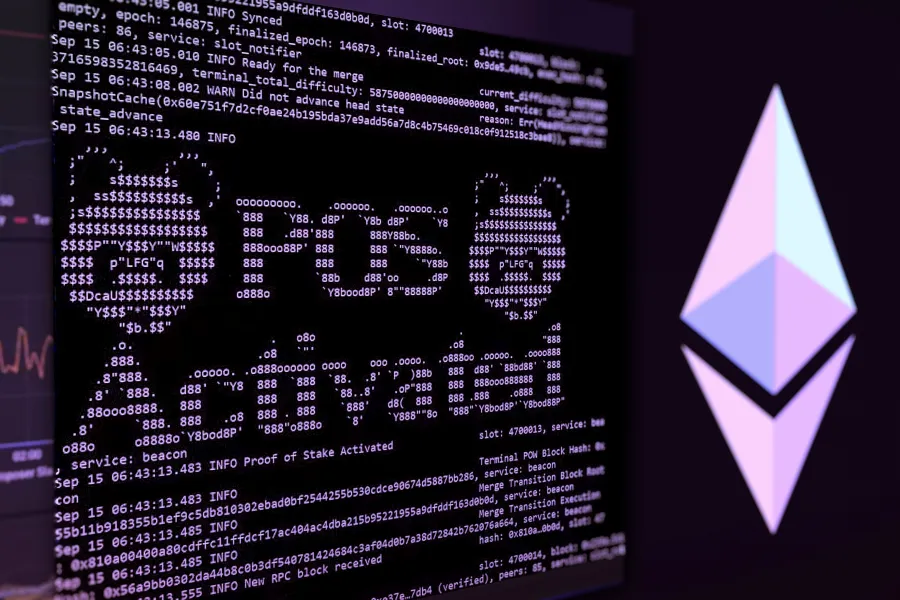

The Merge has happened. What are the takeaways?

The long-awaited Ethereum Merge finally shipped on September 15, 2022, fully turning Ethereum into a Proof-of-Stake (PoS) blockchain. It commenced at 6:43 a.m. UTC and attracted a live audience of over 41,000 people on YouTube that watched as the significant event unfolded. The mainnet and PoS Beacon Chain merged successfully without a hitch, but it was not a small task. “The metaphor that I use is this idea of switching out an engine from a running car,” Justin Drake, a researcher at the Ethereum Foundation, said describing the Ethereum Upgrade.

Crypto contagion goes on – for how long?

The crypto markets have been in restructuring mode for the past few weeks. As time goes on, the market is trying to figure out, who has been owing money to whom. On the borrowing side, Singapore-based crypto hedge fund Three Arrows Capital (3AC) seems to have many open credit relations – too many. The company has already filed for bankruptcy.

Solend – Governance debacle or necessary evil?

The world of decentralised finance (DeFi) is having a rough time. Token values have dropped significantly, and one of its popular projects – Terra’s algorithmic stablecoin UST – completely imploded a few weeks back. Yet another incident that shed some bad light on DeFi recently happened in the Solana ecosystem. Through a governance vote on the Solana-based lending and borrowing protocol Solend, users voted to grant “special” parties the rights to liquidate a borrower’s assets. Although the vote was conducted on-chain, there was a quirky element to it. It was launched without announcement and one wallet paid $700,000 for additional voting power, ultimately making up 90% of votes.

Celsius Drama: Crypto lenders in trouble

Following the publication of yet another 40-year record CPI print of 8.6% in the US on June 10th, the crypto markets corrected heavily. And with prices coming down significantly, the current bear market took its next toll. New York-based crypto lending company Celsius Network saw its own token correct more than 50% in a few hours.

We always deliver our latest press releases, crypto market expertise and in-depth blog posts straight to your inbox. You can pick which topics interest you.