About Bank Frick

We are family-run, entrepreneurial and digital

We are your enterprising bank in Liechtenstein. As a family-run institute, we think long-term – and we have streamlined internal routes to quickly make reliable decisions, so you always know where you stand with us. And although we’re highly digital, personal contact is a top priority for us – and that’s a promise.

Bank Frick specialises in banking for financial intermediaries as well as professional clients based primarily in Liechtenstein, Switzerland or the European single market. We support and advise fintechs, asset managers, payment service providers, family offices, fund promoters, pension funds and fiduciaries.

We offer more bank than others

Our innovative joy is part of the essence of Bank Frick. As a result, we began offering the trading and custody of leading cryptocurrencies in the regulated bank environment as early as 2018. Not even challenging tasks can fluster us.

We can boast outstanding specialist expertise in the field of regulated blockchain banking, in the development of fund solutions, in the tokenisation of shares, in the setting up of capital market issues – and, of course, also in conventional banking. We also provide a wealth of expertise in the field of credit card acquiring.

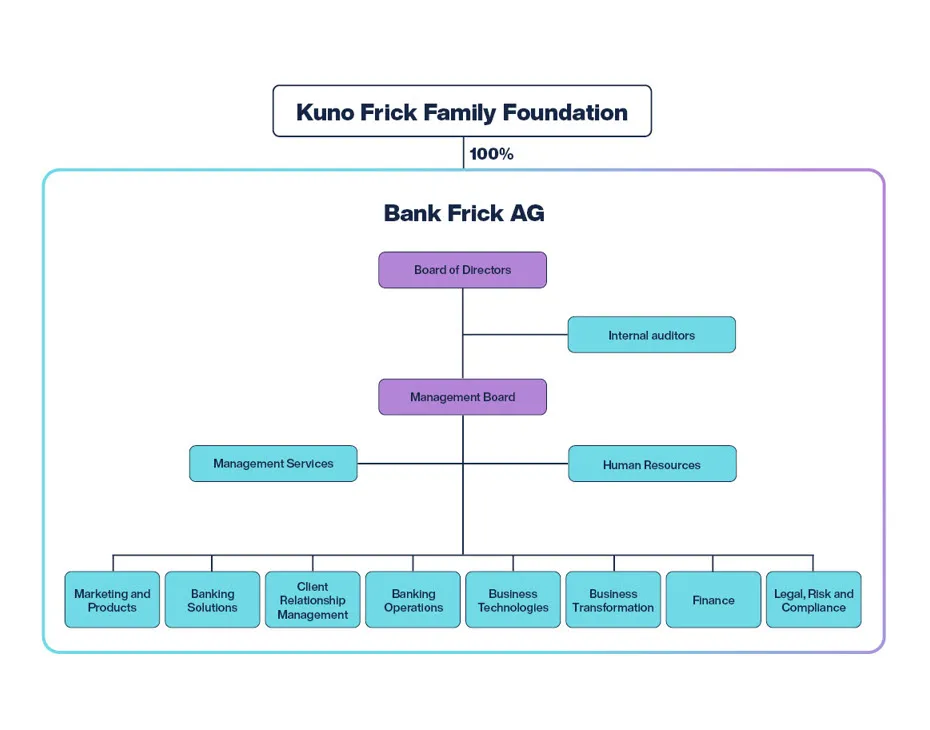

Bank Frick was established in 1998 by the Liechtenstein fiduciary Kuno Frick Sr (1938–2017) together with a number of financial investors. Today, the Bank is owned entirely (100 per cent) by the Kuno Frick Family Foundation. Bank Frick employs over 250 members of staff in Liechtenstein and operates a branch in London.

Lean and effective management structure

The culture of Bank Frick is shaped by flat hierarchies, open offices and direct communication, an approach that enables us to make rapid decisions.